With the presidential and congressional elections less than a month away, many taxpayers are probably wondering whether a new administration and a new Congress might pass sweeping reforms to dramatically alter the current tax landscape. Taxpayers may have to wait until after the November 3 elections to get a better sense of the potential for tax reform; however, in the interim, following these three planning strategies today may help bolster tax savings, regardless of which candidates take office in 2021.

Strategy #1: Increasing Charitable Contributions

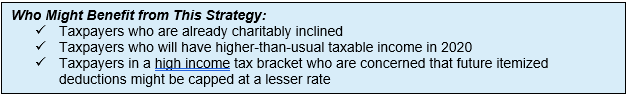

The Tax Cuts and Jobs Act (TCJA) – passed back in December 2017 – increased the deduction limit for cash contributions made to public charities up to 60 percent of adjusted gross income (AGI), from the previous limit of 50 percent.

To assist with COVID-19 pandemic relief while also rewarding charities for providing increasingly vital support during these challenging times, the Coronavirus Aid, Relief, and Economic Security (CARES) Act – enacted this past March – further increased charitable deduction limits. Under the CARES Act, taxpayers can elect on their 2020 income tax return to deduct up to 100 percent of adjusted gross income for cash gifts made in 2020 to public charities.

Important note: The increased charitable contribution limit under the CARES Act does not apply to:

- Donor-advised funds

- Non-public charities

- Private foundations

Importantly, under this CARES Act provision, taxpayers can supplement different types of charitable gifts to take advantage of the increased limits for tax year 2020. For example, a taxpayer could gift long-term appreciated securities to public charities (including a donor-advised fund) up to 30 percent of AGI while also making cash gifts to public charities totaling up to 70 percent of AGI. Any charitable gifts made in excess of the AGI limitations will result in a charitable carryforward over the next five years.

Strategy #2: Using the Lifetime Gifting Exemption

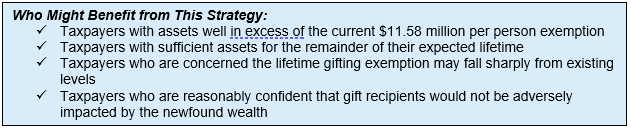

Following the Tax Cuts and Jobs Act, the lifetime gifting exemption effectively doubled, shifting from $5.49 million per person in 2017 to $11.18 million per person in 2018; the lifetime gifting exemption currently stands at $11.58 million per person for 2020. The increased exemption amounts under TCJA are scheduled to run through 2025, after which the basic exclusion amount (BEA) is set to revert to the 2017 level of $5 million per person, plus inflation adjustments.

Although high net worth individuals welcomed the increased exemption amount under TCJA, there had been questions as to whether the Internal Revenue Service (IRS) might apply a “clawback” for past gifts should the exemption revert to 2017 levels. This past November, the Treasury Department and IRS issued final regulations confirming that taxpayers who take advantage of the increased exemption amounts would not be subject to a clawback should the exemption decrease from current levels.

With estimates that less than 0.1 percent of estates pay the estate tax, some politicians are focused on making what they believe to be long-overdue changes to the elevated exemption.

Individuals with assets in excess of the current exemption amount and who have remaining gifting exemption may wish to engage their attorney for a review of their existing estate plans, in consideration of whether to gift assets while the exemption remains at a favorable level

Strategy #3: Converting to a Roth IRA

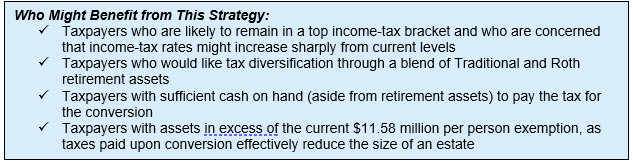

Whereas a Traditional IRA/401(k) is generally funded with pre-tax contributions for which future withdrawals are taxed at ordinary income rates, a Roth IRA/401(k) is funded with after-tax contributions with tax-free qualified withdrawals. Individuals who have a majority of retirement assets in a Traditional retirement account might consider converting a portion of those assets to a Roth retirement account for greater “tax diversification”; with income tax rates currently at historically favorable levels, now might be an opportune time to do a Roth conversion. Individuals should evaluate their income-tax picture to compare their current marginal tax rate against expectations for a future marginal tax rate.

Barring any non-deductible contributions (“basis”) present in Traditional retirement accounts, the IRS treats Roth IRA conversions as taxable income. Given increased charitable limits in place for 2020, individuals might consider a paired strategy that incorporates higher charitable giving to offset the taxable income associated with the Roth conversion.

These are only three planning strategies which, if executed in 2020, could provide meaningful tax savings. There are plenty of other options – or combinations of options – that might also create tax savings opportunities. Individuals who might benefit from these and other strategies should begin the conversation with trusted advisors, such as investment consultants, accountants and attorneys.

For more information, please contact HighMark Wealth Management.